Latest Blogs

Click Here for Details If you’re a catalog marketer, there’s exciting news on the horizon: The USPS Catalog Mailing Incentive goes into effect August 15, 2025, offering substantial postage savings just in time for peak campaign planning and holiday mailings. What Is the USPS Catalog Mailing Incentive? The USPS Catalog…

Read MoreThe U.S. Postal Service will implement new postage rates effective July 13, 2025. These changes will impact commercial mailers, catalog publishers, periodical publishers, and direct mail marketers. Understanding the specifics of these updates can help you plan budgets, optimize mailing strategies, and take advantage of available discounts. Key Rate Changes…

Read MoreRich Graham Director -Direct Mail Division, Modern Litho – St. Louis FOR IMMEDIATE RELEASE: Modern Litho-St. Louis Strengthens Market-Defining Direct Mail Capabilities with Key Talent Acquisition ST. LOUIS, MO, JANUARY 22, 2025 – Modern Litho, a leading full-service publication and commercial printer, today announces a significant expansion of its direct…

Read MoreIt’s been a busy year here at Modern Litho! Join us for a look back at all that’s been accomplished in 2024. And thank you for being a part of our journey!

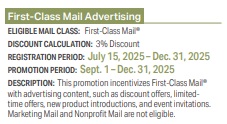

Read MoreWatch Our 2025 USPS Promotions Webinar The USPS 2025 Promotions Program is off and running offering postal discounts ranging from 3% up to 6%! The incentives are offered to qualifying direct mail pieces that integrate advanced technology, tactile elements, sustainable materials, and more. These discounts can make a significant impact…

Read MoreMaximizing Savings and Efficiency for Letter Rate Standard and Nonprofit Mailings Commingling direct mail is a strategic process that helps businesses and organizations save on postage costs and speed up delivery times. This technique, relevant to letter rate standard and nonprofit mailings, merges mail pieces from multiple companies into a…

Read MoreGreg Meeker, Chief Revenue Officer FOR IMMEDIATE RELEASE: Modern Litho Announces the Retirement of Greg Meeker, Chief Revenue Officer Jefferson City, Missouri – July 2, 2024 – Modern Litho, a leading Midwest-based commercial and publication printer, today announced the retirement of Greg Meeker, Chief Revenue Officer, effective June 30,…

Read MoreThe United States Postal Service has posted updated 2024 rate changes. The price changes will take effect on July 14, 2024. First-Class Mail Forever stamp will increase by five cents to 73¢. First-Class domestic postcards will increase to 56¢. Percentage increases by class: 1st Class letters 5 Digit: 7.49% AADC:…

Read More